Popping up here and there around America and elsewhere in the world are what people have been calling tech-flex buildings.

Originally, a tech-flex building (TFB) was to be a configurable, shared space for startup companies. But, it hasn’t turned out that way: it’s too expensive and overkill.

Sometimes built from scratch, the TFB is usually converted from a vacated factory or warehouse and, therefore, has high-bay ceilings (at least 20 feet tall), loading docks, drive-in doors, factory-grade electrical power and water, and office space..

To greatly enhance the financials, developers have found it wise to locate a tech-flex building in an IRS-defined Qualified Opportunity Zone (QOZ) and in proximity to research-oriented universities, a strong pool of science-educated professionals, mass-transit, and a respectable airport.

How does one brand and sell a tech-flex building?

For starters, stop calling it a tech-flex building. Here’s why:

|

REMEMBER: Confusion is the antithesis of branding and selling — and your enemy.

The Reality

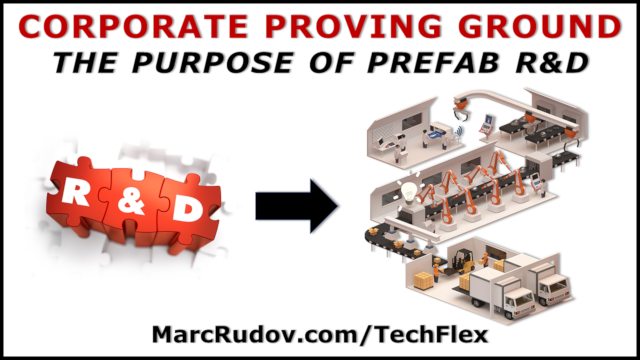

Tenants of these facilities tend to be large corporations that build physical products, seeking proving grounds to test new business concepts. They need a relatively small amount (20K+ square-feet) of R&D, fabrication & testing, assembly, and office space — and want to move in with relative ease. They don’t want the hassles of creating R&D space from scratch and dealing with city ordinances and bureaucrats.

The solution: replace the “tech-flex” moniker with prefab R&D.

Prefab R&D Examples

Caterpillar (NYSE: CAT), the giant manufacturer of earth-moving equipment headquartered in Deerfield, IL, in 2017 began leasing 10,000 square-feet of shared space (out of 65,000 sq-ft) for its automation center at the Tech Forge in Pittsburgh, PA. Caterpillar made this move because of the high concentration of robotics expertise in the Lawrenceville section of Pittsburgh.

In October 2021, Evoqua (NYSE: AQUA), formerly Siemens Water Technologies, a purveyor of mission-critical water-treatment solutions, took 18,000 sq-ft at Tech Forge for its Sustainability and Innovation Hub: a hands-on demonstration and training area, pilot-testing environment, and a state-of-the-art laboratory to grow its analytical and feasibility-study capabilities.

Architectural firm DLA+ is working with Oxford Development to reconfigure an old warehouse in Pittsburgh’s Strip District to create Factory 26, a 55,500-sq-ft space for up to four tenants (5,000 sq-ft minimum each). It will be a mix of commercial, R&D, light manufacturing, and tech showrooms.

Pittsburgh-based Elmhurst Group is erecting a two-building, 160,000-sq-ft (20,000-sq-ft minimum) “prefab-R&D” facility on Technology Drive in Pittsburgh’s South Oakland area. It is eponymously named the Elmhust Innovation Center, scheduled to open in April 2022.

The 51 Bridge Street facility in Etna, PA (just north of Pittsburgh), a former pipe mill built in 1902, wants to be known as an innovation hub. It offers 88,000-sq-ft of space, designed for assembly and R&D. Unfortunately, as seen below, this facility is emblazoned with the nebulous “Techflex” on its building. This is a mistake.

George Mongell, founder and CEO of Westrise Capital, purchased a commercial-laundry facility in an Opportunity Zone in the Uptown section of Pittsburgh. He is busily converting it to prefab R&D. Uptown LaunchPad, scheduled to open in January 2022, provides a spectacular view of the Monongahela River, 43,000 sq-ft of factory space on the ground floor, and 17,000 sq-ft of office space on the top floor — plus a conference room and a recreation area on the roof. Uptown LaunchPad is equipped with industrial-grade power and water, has ample parking (including 18 indoor spaces), a drive-in entrance, and a loading dock. For a city-based facility, with close proximity to research experts at the University of Pittsburgh and Carnegie Mellon University, this location could not be better.

Parting Advice to Developers, Architects, and Brokers

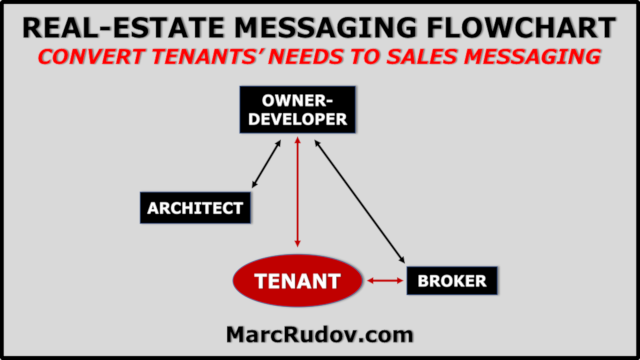

Branding, and therefore selling, requires using succinct, resonating customer language — not vendor or industry jargon.

Tenants want prefabricated, shared R&D spaces — easy to occupy and configure — to use as proving grounds for new business concepts. So, prefab R&D is what you should label it, and an easy-to-occupy proving ground is how you should sell it — differentiated, of course, from what your competitors say.

Constantly monitor the R&D activities of large corporations. Have your broker(s) lure them to your space.

Remember that, once firms like Caterpillar and Evoqua validate their R&D efforts as commercially viable, and outgrow their proving grounds, they will buy or lease their own buildings.

Pitching your facility based on square-footage and ceiling heights (the generic, default real-estate patter), renders it a generic commodity. Generic commodities = low prices. Brokers must be able to pitch your facility easily, succinctly, and compellingly to prospective tenants.

As a developer-owner, glean sales messaging from your prospective tenants and then teach that messaging to your architects and brokers. Tell them to stop using tech-flex and replace it with prefab R&D: that’s what the well-heeled tenants want.

Also, give your building a unique name: one that conveys the purpose of the building, according to tenants, and resonates with said tenants. A name is not a brand; it’s an identifier. Prefab R&D is not a brand; it’s a category.

A brand is intangible, the emotional connection that customers have with a vendor, one that you must convert into words and images.

In a city like Pittsburgh, where there are multiple properties competing to house those R&D ventures, developers and their brokers must articulate unique value propositions to convince prospective tenants to lease from them.

Bottom line: Why should your facility become any corporation’s new-venture R&D home?

© 2021 Marc H. Rudov. All Rights Reserved.

About the Author

Marc Rudov is a branding advisor to CEOs,

producer of MarcRudovTV, and author of four books